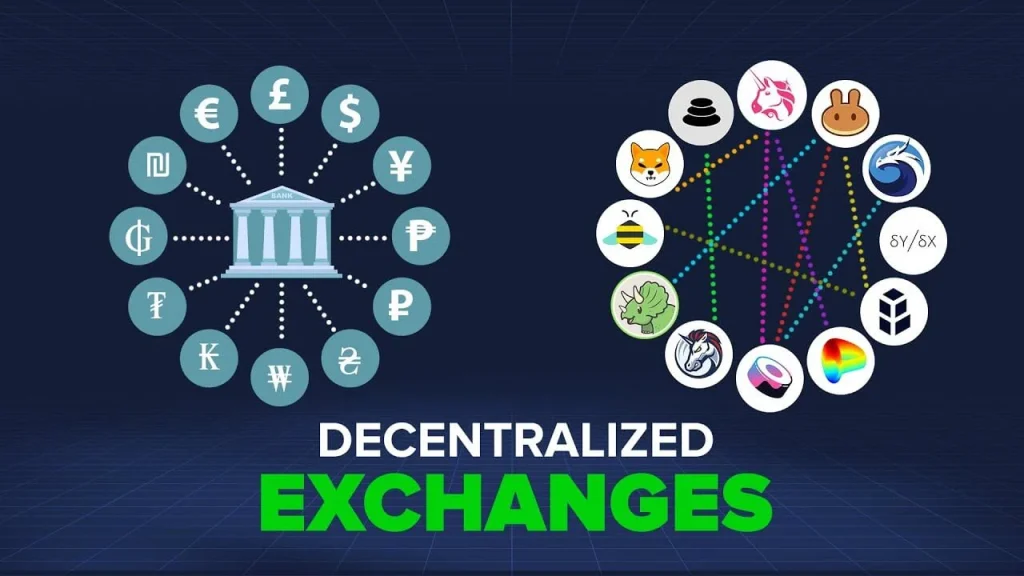

The financial market undergoes rapid changes thanks to decentralized exchanges (DEXs) which act as key elements in cryptocurrency trading. DEXs provide an autonomous trading platform that runs on blockchain technology because they operate outside of centralized exchanges. This system gives users both security and unrestricted access without needing any third-party involvement. New users alongside experienced traders can use this guide to discover DEX operating principles alongside benefit and drawback analysis and decentralised trading optimization techniques.

Understanding Decentralized Exchanges (DEXs)

Regarded as one of the cryptocurrency exchange types DEX functions autonomously without governing oversight. Users engage in direct digital trading by utilizing smart contracts to maintain transparency along with security. DEXs operate without fund possession which means users face reduced risks of hacking and fraudulent activities.

Key Features of DEXs

Trading between peers happens in direct fashion since both parties bypass all intermediaries.

Non-Custodial: Users retain control of their private keys and funds.

- The system conducts exchange operations automatically through smart contracts that execute contracts themselves.

- The trading process at DEXs provides unregulated permissionless access to users who hold cryptocurrency wallets so KYC procedures become unnecessary.

- A public blockchain keeps track of transactions which provides both secure record keeping along with transparent operations.

How DEXs Work

The trading system implemented through DEXs depends on blockchain technology as well as smart contracts. The following sequence explains the standard process for securing a DEX trade:

- The user interface of DEX networks requires users to link their cryptocurrency wallets which can be MetaMask, Trust Wallet or Coinbase Wallet.

- Users navigate to the trading interface and set their desired pair of tokens such as ETH/USDT and BTC/DAI.

- The automated smart contract system matches traders’ orders for buying and selling assets whereas users can also execute direct trades by accessing liquidity pools.

- After blockchain verification occurs the exchanged tokens get automatically delivered to the holding wallet of the user.

Types of DEXs

1. Automated Market Makers (AMMs)

AMMs set their prices through a system which combines pool assets with tech algorithms. Dex users execute their trades against pool-based liquid assets rather than performing direct trades against other platform participants.

- Examples: Uniswap, SushiSwap, PancakeSwap

- Pros: High liquidity, passive income for liquidity providers

- Cons: Impermanent loss, high slippage in low liquidity pools

2. Order Book DEXs

DEXs maintain a design similar to conventional exchanges by connecting buyers and sellers through their order book system.

- Examples: dYdX, Loopring

- Pros: More control over trade execution, less slippage

- Cons: Requires more active trading strategies

3. Hybrid DEXs

The hybrid DEX model implements features from order book technology to integrate with AMM methodology and produce superior system performance.

- Examples: Serum, Injective Protocol

- Pros: Faster transactions, lower fees

- Cons: More complex mechanisms

Benefits of Using DEXs

- DEXs enhance user security because they do not store funds within a unified wallet system.

- DEX users retain complete dominance over their monetary assets.

- Charts offer privacy to traders because KYC requirements do not exist on these platforms.

- DEXs normally add newly emerging tokens to their platforms before centralized exchanges recognize them.

- The internet accessibility allows anybody worldwide to participate which broadens financial opportunities for all individuals.

Challenges and Risks of DEX Trading

- DEX trading presents several difficulties that all participants need to handle.

- Vulnerabilities within smart contracts due to bugs result in exploits.

- DEX trading on Ethereum-based platforms involves high costs due to congestion-related gas fees.

- Liquidity providers face potential asset price-driven losses through impermanent loss.

- DEX interfaces often pose difficulty for novice traders because they have complicated user interfaces.

- Some token markets display restricted liquidity because it creates substantial slippage in their transactions.

How to Use Decentralized Exchanges (DEX) Safely and Effectively

1. Use a Secure Wallet

The selection of MetaMask or Trust Wallet or Ledger as your wallet choice ensures maximum security. The storage of your private keys should always stay secure and you must avoid giving anyone access to them.

2. Verify the DEX Platform

Verify both the integrity and auditing process of the DEX platform that you plan to use. Need to avoid phishing attempts while accessing the official website because it helps prevent scams.

3. Enable Security Features

Users should enable MFA security measures wherever possible since using hardware wallets with antivirus software installed on protected devices promotes better security practices.

4. Understand Gas Fees

Always inspect gas charges before conducting a transaction by timing the trade appropriately. Too much network congestion may lead to unreasonable transaction expenses.

5. Review Smart Contracts

Verify smart contracts for new tokens or liquidity support by using Etherscan or BscScan platforms in order to detect potential scams.

6. Use Slippage Control

Cautious attention must be given to slippage settings because vigorous adjustments will avoid major losses in volatile conditions. Low slippage values create failed transactions but high slippage values produce unfavorable trades.

7. Start with Small Trades

You should start with modest transactions when introducing yourself to a DEX because this helps test both the system and prevents big monetary losses caused by mistakes.

8. Exercise Caution Against Projects That Perform Rug Pulls and Scams

Make sure to research both tokens and projects before starting any investment. Investors should steer clear from pools or tokens where developers stay hidden because there is no published roadmap and they have unknown backgrounds.

9. Monitor Your Transactions

A routine review of wallet transactions and historical record will help confirm only authorized activities have taken place. You should monitor your blockchain transactions through the use of explorers.

10. Stay Informed

The DEX ecosystem requires users to stay informed by following reliable DeFi news outlets alongside community discussions and security updates so they can operate effectively.

Strategies for Successful DEX Trading

1. Understand Liquidity Pools

Check the liquidity levels of an AMM-based DEX before trading because high slippage could occur.

2. Monitor Gas Fees

The Ethereum gas prices can be tracked through Etherscan and GasNow so that you can perform trades when fees reach low points.

3. Use Limit Orders (if available)

The trading platforms dYdX and Loopring provide their users opportunity to set limit commands to improve trade completion rates.

4. Diversify Your Portfolio

To prevent maximum loss you should distribute your assets between multiple tokens which span across multiple blockchain networks.

5. Stay Updated on Market Trends

Check DeFi news sources together with Twitter and Discord groups to track upcoming events and new token releases.

Future of Decentralized Exchanges

The advancements in DEX trading create a positive picture of its future development.

- Layer 2 scaling solutions implement technology that decreases gas expenses concurrently enhancing protocol operational speed.

- Thorchain project represents one such integration that establishes trading connectivity across multiple blockchain platforms.

- Improved User Interfaces represent the ongoing development of DEXs dedicated to attract mainstream traders.

- Government institutions work to develop regulatory frameworks regarding decentralized finance (DeFi) that might affect DEX functions.

Conclusion

Those who want to excel at DEX trading need a thorough knowledge of decentralized finance (DeFi), smart contracts and methods to manage risks in the market. Staying up to date with market shifts alongside optimal trading techniques and knowing industry best practices enables users to thrive in decentralized exchange operations effectively.